Last Day Of The Calendar Year For Taxes

Last Day Of The Calendar Year For Taxes – not only to access essential benefits and deductions but also to comply with tax regulations and circumvent significant penalties associated with delayed payments. Employing a tax calendar facilitates . The income tax department has published a comprehensive tax calendar on ending March 2024. The last day for issuing certificates of tax deducted at source to employees for salary paid and tax .

Last Day Of The Calendar Year For Taxes

Source : www.investopedia.com

Federal Income Tax Deadlines

Source : www.thebalancemoney.com

Fiscal Year: What It Is and Advantages Over Calendar Year

Source : www.investopedia.com

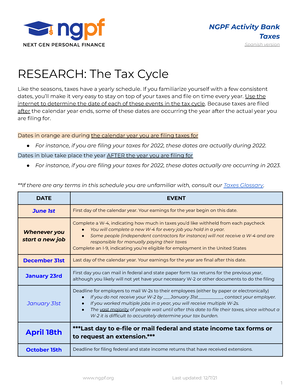

use the Interto determine the date of each of these events in

Source : brainly.com

Year to Date (YTD): What It Means and How to Use It

Source : www.investopedia.com

What Is a Tax Year?

Source : www.thebalancemoney.com

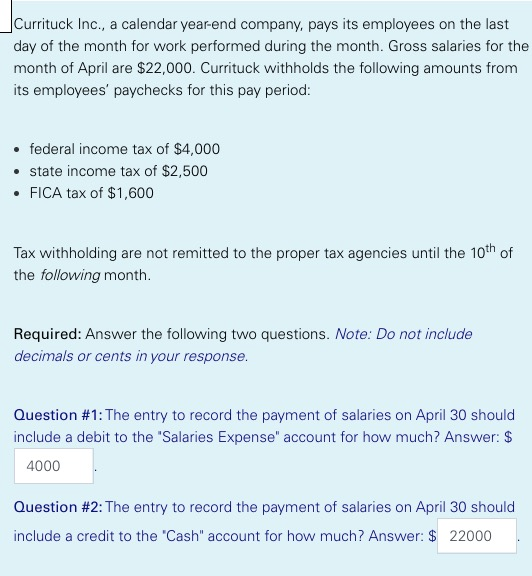

Solved Currituck Inc., a calendar year end company, pays its

Source : www.chegg.com

Taxes 1.3 Research The Tax Cycle NGPF Activity Bank Taxes

Source : www.studocu.com

Fiscal Year: What It Is and Advantages Over Calendar Year

Source : www.investopedia.com

Tax Filing Deadline Dates 2024

Source : www.fusiontaxes.com

Last Day Of The Calendar Year For Taxes What Is the Tax Year? Definition, When It Ends, and Types: The above ITR filing dates are for those filing income tax returns for their earnings during the 1st April 2018 to 31st March 2019 period. Additional List of Tax Events in the AY 2019-20 period The . The last date to file income tax returns for individuals whose accounts are not audited is July 31, 2024. If you specifically opt for old tax regime for next financial year i.e., FY 2023-24, then .

:max_bytes(150000):strip_icc()/taxyear-c3f5618cd504499583b0543cb4d6b31e.jpg)

:max_bytes(150000):strip_icc()/balance-tax-return1-8b74d7fde2b44e5baa394d2ceda7d730.jpg)

:max_bytes(150000):strip_icc()/FY-887c7c1cad1c47f38bd91db6e080b68e.jpg)

:max_bytes(150000):strip_icc()/YTD-V2-2a43c52527b840ee946b51e2efeb1a4c.jpg)

:max_bytes(150000):strip_icc()/tax-year-defined-1293735_final_rev_3_25_21-92ca8c2a3f9c4515ad8b71d04f4d4b0d.png)

:max_bytes(150000):strip_icc()/FiscalYear-End_v1-e3337960a07c4b9f9a9d394e934caca2.jpg)